Hodar Report Investment PortfoliosDr. Jody Wilson's investment strategies |

Outlook & Strategy - Gurus - Data - Quantitative Forecasts |

Mutual Fund PortfolioUpdated November 15, 2023 |

||

| Allocation | Fund Symbol & Name | Description |

| 25% | EIPCX Parametric Commodity Strategy Fund |

Commodity prices (futures) |

| 25% | EPGIX EuroPacific Gold Fund Fidelity Select Gold Portfolio |

Gold mining stocks |

| 19% |

EPVIX EuroPac International Value Fund |

Foreign value stocks |

| 6% |

EPEIX EuroPac Emerg. Mrkt. Small Company Fund |

Emerging Market stocks |

| 25% |

EPBIX EuroPac International Bond Fund |

Foreign bonds |

| 100% | Total | |

| 1/4 of my net worth | Physical Silver & Platinum | APMEX, SD Bullion, Provident Metals Golden State Mint, JM Bullion Monarch Precious Metals |

ETF PortfolioUpdated November 28, 2023 |

|

| Type/Sector | Exchange Traded Funds (ETFs) |

| Gold & Silver Mining Stocks | 10% SGDM: Sprott Gold Miners 10% GOAU: US Global GOLD & Precious Metal Miners |

| Physical Silver, Gold & Platinum |

10% PSLV: Sprott Physical Silver Trust 10% GLTR: Aberdeen Physical Precious Metals |

| Foreign Bonds/Currency |

10% WIP: International Government Inflation-Protected Bond 10% ISHG: 1-3 Year International Treasury Bond |

| Foreign Stocks |

15% ICOW: International Cash Cows 2.5% FEMS: First Trust Emerging Markets Small Cap AlphaDEX 2.5% ECOW: Emerging Markets Cash Cows |

| Commodity Futures |

20% DBC: Invesco DB Commodity Index |

Outlook and StrategyThe United States is insolvent, and the dollar is about to die. Record amounts of debt at every level of government and in the private sector have prompted the Federal Reserve Bank to digitally "print" dollars into existence to stave off national bankruptcy, but creating more dollars ultimately makes each dollar proportionally less valuable. The debt will keep growing, so the Fed will keep printing, and the dollar will be sacrificed as a result. Most Americans will become impoverished one way or another. How to Win during a Currency Crisis In previous cases of high inflation, the prices of gold and silver have risen to account for all of the new currency created, because precious metals are the only commodities with all of the characteristics of real money; in particular they retain their properties and true value over long periods of time. For instance, during the "stagflation" of the 1970's (high inflation with a stagnant economy), gold rose in price from $42 per ounce to briefly pass $800 per ounce in 1980. During the same period, silver rose in price from less than $2 per ounce to more than $40 per ounce. Today gold is undervalued by at least a factor of 6 relative to the currency supply, while silver is undervalued by at least a factor of 30; history says that they will inevitably rise in price to account for the difference. Broad Strategy I have positioned my savings to profit from the collapse of the dollar, using the wisdom of unconventional investors like Peter Schiff, Mike Maloney, and Greg Mannarino. Precious metals, which used to be money and which will be money again, are undervalued by historical standards, so they offer the lowest risk of any investment today, especially if the actual coins and bars are held in the investor's control. Silver in particular is very cheap, and it features prominently in each of my portfolios. Commodities like fossil fuels, industrial metals, and agricultural goods are also inexpensive and poised to make large gains. Portfolio Strategy (Updated August 15, 2021) My portfolios are divided into the following five major parts: (1) physical silver, (2) gold mining stocks, (3) commodities, (4) foreign bonds/cash, and (5) foreign value/dividend stocks. I will re-balance these portfolios when one or more of the components makes a larger gain than the others, and in the event of a price drop across all categories, I'll move some of the foreign cash into the other four parts. Most importantly, when the dollar experiences a sharp drop, all five components will gain in dollar terms. Mike Maloney has invested the majority of his net worth in physical silver due to its extremely low price - and correspondingly high potential - relative to all other assets. Approximately 25% of my net worth is tied to physical silver. Peter Schiff sees a wider range of opportunities beyond physical metals. His high-reward play is the gold mining sector, whose profits will increase by multiples of the metal price. Schiff also sees potential in foreign stocks in certain countries who have dollar-denominated outstanding debt, because when the dollar collapses in value, foreigners will effectively have their debt forgiven thanks to the improving exchange rates. Foreign consumers will have more purchasing power, and foreign companies will become more profitable. Peter Schiff's international and gold mining mutual funds make up the the majority of the Mutual Fund Portfolio. Greg Mannarino is both a short-term options trader and long-term investor in alternatives to the dollar. His motto is "Become your own central bank," which means holding physical precious metals, particularly silver, along with cryptocurrencies. Mannarino is somewhere between Mike Maloney and Peter Schiff in his long-term investment strategy, while his options-trading mindset probably explains why he likes cryptocurrencies more than either Schiff or Maloney. He has recently begun to invest in large U.S. dividend-paying stocks. |

The Big Table of Investment GurusUpdated November 28, 2023 |

||||

| Peter Schiff | Mike Maloney | Greg Mannarino | ||

| Long-term Investments |

- Physical gold, silver - Gold-mining stocks - Foreign value stocks - Commodities - Short-term foreign bonds |

- Physical silver - A few mining stocks - Altcoin cryptocurrencies - Farmland |

- Silver , gold, platinum - Commodities (PDBC) - U.S. Dividend-paying Stocks (JEPI) - Cryptocurrencies - Artwork, classic cars, collectables |

|

| Short-term trades | None | None | Buy the dips | |

| Long-term U.S. stock market forecast |

Down relative to gold, silver, and other commodities |

Down relative to gold and silver |

Bond market will eventually crash, followed by stock market crash |

|

| Long-term Bitcoin forecast |

Bitcoin eventually goes to zero with all cryptocurrencies; they’re all worthless |

Bitcoin will be supplanted by more efficient altcoins |

Greg doesn't care. Just invest in multiple "anti-dollar instruments." |

|

| Long-term dollar forecast |

Much lower, possibly hyper-inflationary crash; Savers will be wiped out by high prices |

Dollar goes to 0 as all currencies eventually do, resulting in the “Greatest wealth transfer in the history of mankind” |

Much lower; Middle class Americans are becoming serfs |

|

| Predicted behavior of U.S. government & Federal Reserve |

Borrow ever more money (sell treasury bonds) while the Fed prints dollars and buys the bonds to keep long-term interest rates low |

|||

US Money Supply Change |

Precious Metal Prices |

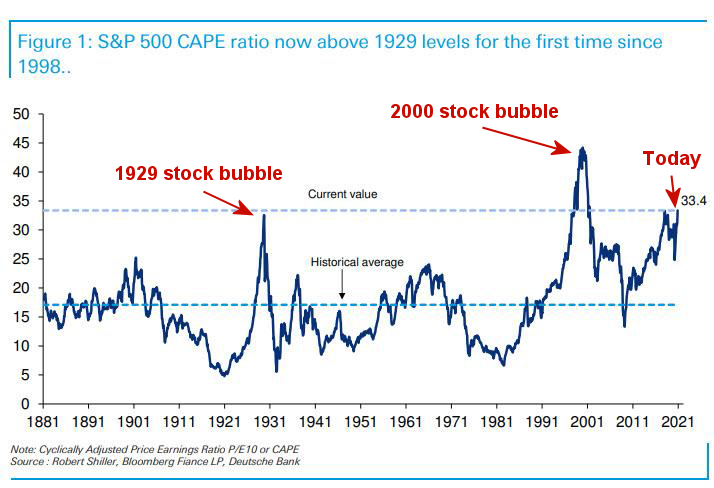

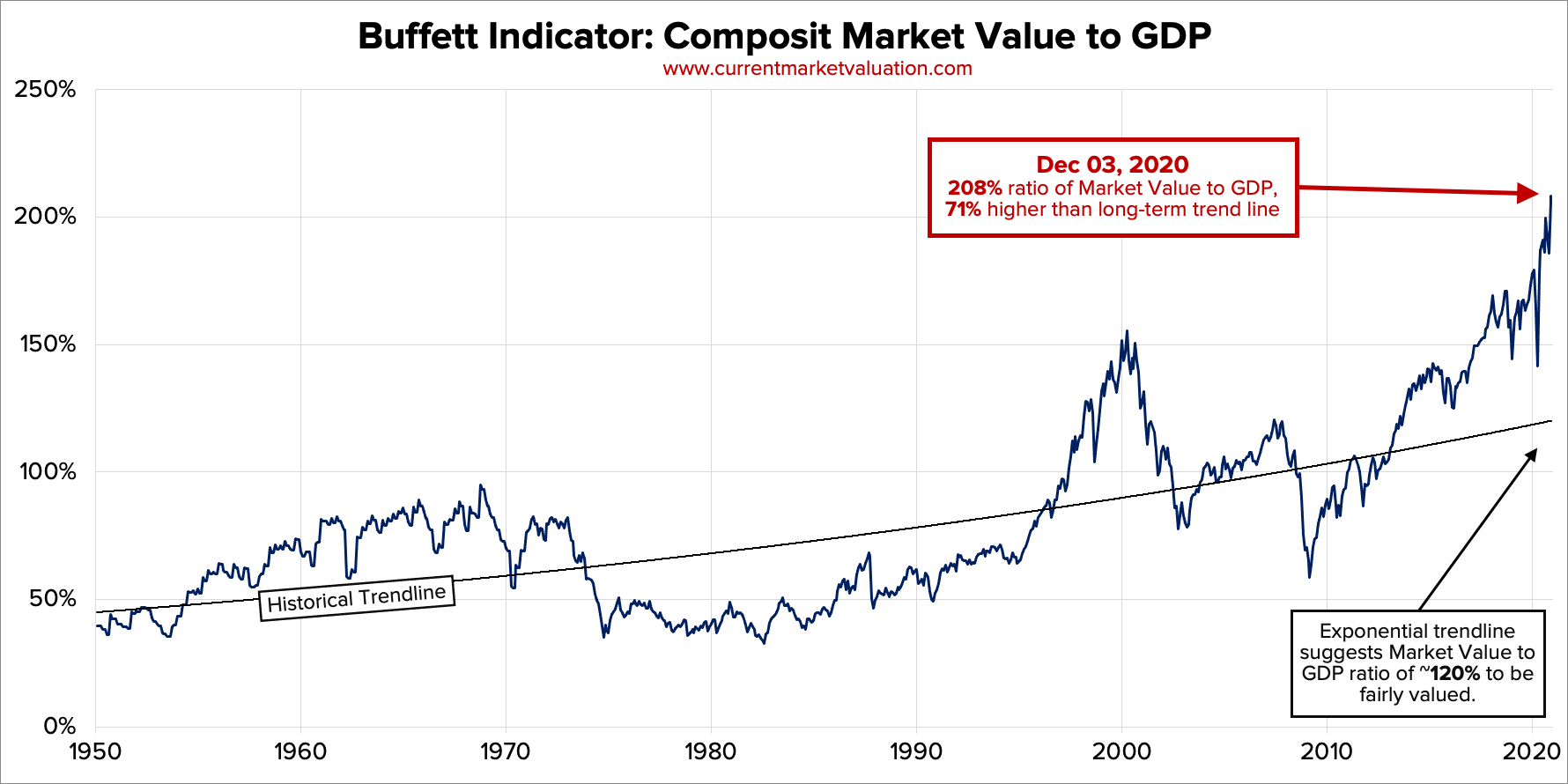

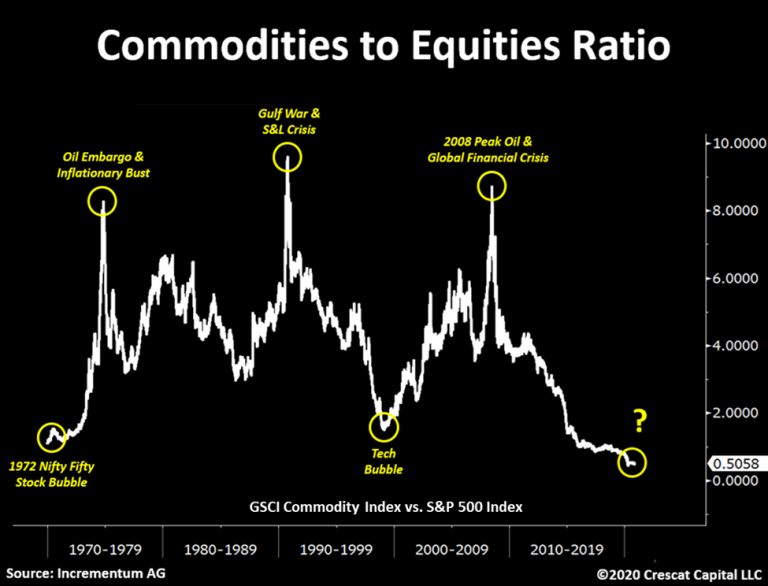

US Stock Market Bubble VisualizedForeign value and dividend stocks remain at bargain prices. |

US Stock Market Cycle-Adjusted P/E Ratio (CAPE) at Extreme Bubble Level CAPE Ratio will return to the ~5 level eventually |

"Buffet Indicator" at ALL TIME HIGH Buffet Indicator = Total Stock Market Value / National Economic Output |

Commodities-to-Equities Ratio at ALL TIME LOW Commodities include fossil fuels, agricultural products, livestock, and industrial metals |

Silver is historically cheap relative to US stocks |

Silver is historically cheap relative to the average US home price |

Forecasts(updated April 3, 2021)

|

Mike Maloney's Forecast |

Debt Clock |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||